We recently supported a global software company bring its job architecture work to life by creating a harmonized global compensation structure.

Industry: Enterprise Software

Organization Size: 2,000 employees in >15 countries

Context: Compensation Structures Activate Your Job Architecture

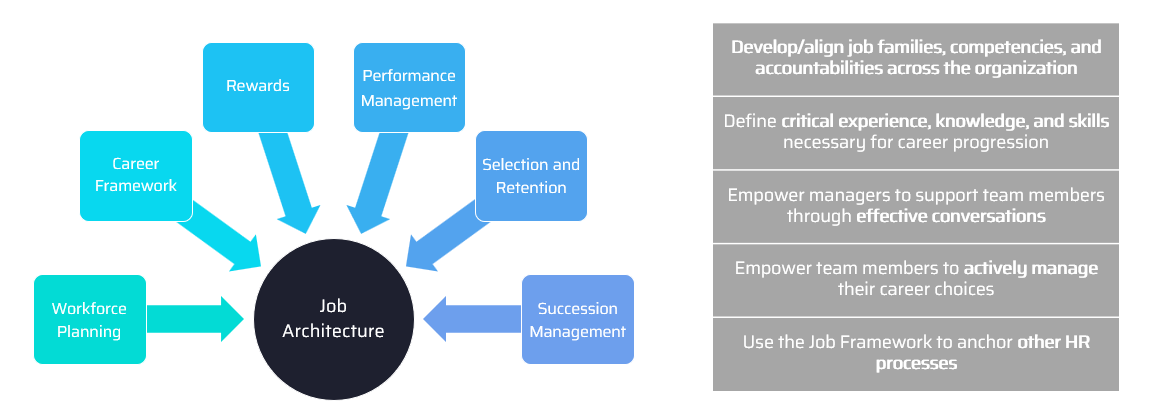

As organizations look to clarify career paths and development opportunities, they are investing considerable time and energy into articulating their job architecture. The job architecture helps employees and support functions understand different types of work, how they relate to one another, and what career progression looks like through job levels. The job architecture becomes a critical foundation for a variety of People programs and strategies.

While the job architecture is a critical foundation to many programs, perhaps the most critical link is to your compensation structure. The compensation structure is what shapes how employees experience your job architecture through their employment cycle. Especially as workers desire more transparency around pay opportunity, and as pay transparency becomes an increasingly regulated matter, a sound approach to managing pay opportunity across roles becomes essential.

Client Challenge

Our client’s Rewards team had recently created a job architecture, built from the Radford level descriptors model, which had been fully implemented into their Workday tenant and way of working. Our client desired expert guidance on how to best design a competitive structure to accomplish the following key objectives.

Ensure Scale As Growth Occurs

Prior to this engagement, the client was market pricing each job as it was being created or deployed into a market, providing guidance to the HR Partner and Talent Acquisition teams on a case-by-case basis. For certain high-volume roles, like Software Engineers and Customer Success Managers, some bespoke job-based ranges were created, but one-off discussions were still required to localize those ranges as hires occurred in new geographies.

With a compensation team of "One Plus" (a dedicated Compensation Analyst, plus a Compensation + Benefits leader), ad-hoc market pricing for each role was unsustainable.

Accommodate a Global, Multi-Functional Workforce

In recent years the organization expanded globally, and in particular was making an investment in its India talent base. Local norms were developing based on the experience and preference of local leaders, often resorting to "percent of the United States rate" shortcuts when making hires. The organization had not yet utilized and shared global compensation benchmarks.

In addition to global expansion, the organization wanted to ensure that it could consistently attract talent into all of its functional areas, and in some cases intended to have a different market positioning for certain roles. The organization was finding product innovation success by acquiring top-flight engineers, but did not feel like it needed to pay all roles across all functions at a premium market position.

Support Evolving Pay Transparency

The client was complying with all applicable regulation, but to date had been taking a more reactive approach. The inconsistency of posted pay ranges (due to each job being market priced separately) was starting to raise some concern, as communication with employees and candidates becomes challenging with many small variations to pay ranges.

Solution

To address these issues, our client hired Novo Insights where we took the following solution approach:

Philosophy Clarification

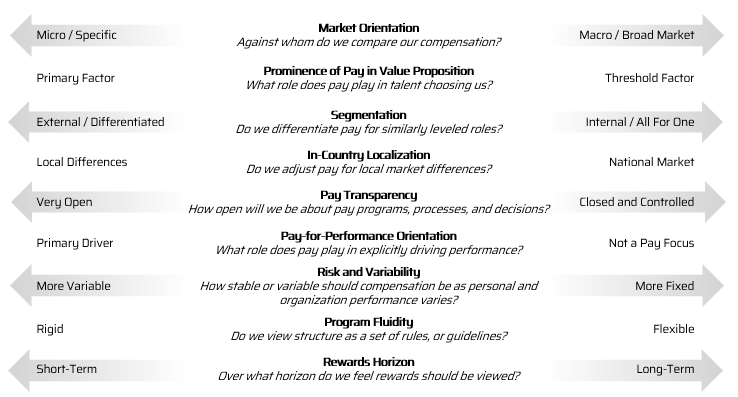

Our client agreed that a compensation philosophy is about more than just what percentile of the market you want to target. That's part of the story, but not the whole story. Through an interactive workshop with key stakeholders, we understood their legacy, current, and desired future states on a number of key compensation trade-offs that shape a philosophy.

Global "Level/Cluster" Compensation Structure

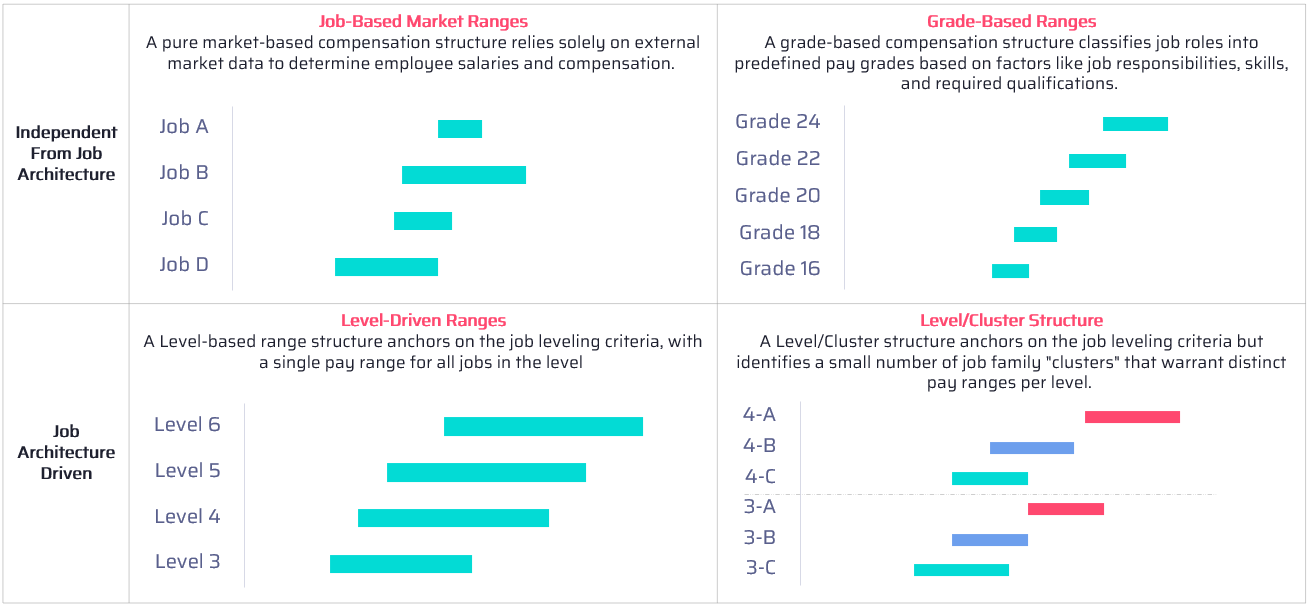

Our view is that compensation structures tend to be variations on one of four key archetypes. We worked with our client to discuss how these archetypes might fit with their compensation philosophy and solution vision.

After discussions, we aligned on using a "Level/Cluster" design. This strategy is relatively new to many organizations, but the Novo Insights team has been using this or similar designs both in our operating roles or with clients for nearly a decade. This strategy helped this client reinforce the hard work they completed around job leveling, but enables strategic use of pay ranges to align to specific functional market alignment.

Impact and Pay Equity Analysis

Once the structure was finalized, we conducted a comprehensive impact analysis to identify any notable gaps in market competitiveness and support related decision-making. We used a number of analytical methods to assess how well the structure fits to market, whether the structure creates a bias toward over/under paying relative to the desired market positioning, and how the ranges fit the current population. We also analyzed the impact from a pay equity lens using our internal modeling tool, built to support U.S. OFCCP Pay Equity Requirements, and identified any statistically significant disparities that may require mitigation.

Operational Readiness

As former practitioners, we understand that the ability to operationalize a structure is just as important (if not more important) as designing a great structure. We supported these efforts in two distinct ways.

First, we collaborated with our client to ensure a clear path to implementation with their Workday HCM. Workday's Compensation functionality is flexible but requires working and thinking in a particular way to ensure all jobs are aligned to the structure as desired.

Second, we documented a set of compensation operational guidelines for ongoing use, including the reasoning, choices, and successful practices associated with key reward scenarios - from salary ranges for job postings to handling internal transfers to annual compensation cycle decisions.

Key Insights

Clustering methodology depends on unique client needs: A key decision point in the structure design phase for this type of compensation structure is the determination of how to cluster jobs within a level, each with associated tradeoffs on administrative lift, communication ease, and market alignment. The three approaches we explored for this client were clustering by job group (clusters pre-determined based on desired segmentation), job family (grouping job families within a job level by similar market value), or job (grouping individual jobs within a job level by similar market value). A deep discussion of the tradeoffs and data modeling ultimately led our client to make the best choice for their organization.

Novo Insights prioritizes a tailored solution to meet each client’s unique needs, and this came to life through this engagement when our client’s preference was a blend of two approaches – carving out Sales as a unique job group and cluster, and the rest of the organization structured into clusters by job family. This choice was primarily driven by their prioritization of market competitiveness and ease of communication broadly.

The number of clusters per level correlates to clustering methodology: When opting for the job grouping cluster strategy, the number of clusters per level can be intuitive based on desired segmentation. In the context of the job family and job methodologies, the clusters are based on segmentation by market value (i.e. low, mid-range, and high valued jobs/job families clustered together), with more clusters resulting in more market precision but additional administrative burden. In addition, we found that beyond 5 clusters you begin to deviate from a level/cluster compensation structure and a closer to job-based market pricing, thereby undermining the original intent of the strategy. Ultimately, the optimal fit for our client was 4 clusters – one for Sales (as outlined above), and a low, mid-range, and high-range structure for the remaining job families in the organization.