Organizations deploy trillions in capital to acquire new businesses, but the majority of those deals fail to realize the projected value. Much of that failure can be explained by poor people integration strategies.

It's a research topic and case study in every MBA program, and a new spin can be found in Harvard Business Review every few years. Over time, we consistently see that organizations invest heavily in acquiring other companies as part of their strategy, but as many as 90% of mergers and acquisitions fail.

Acquisition failure has several sources, some of which are beyond the realm of the integration strategy. Paying too much, or simply epxecting more COGS synergies than can be realized, can doom even the most effective integration plan.

From a People perspective, we find that many analysts quickly summarize deal failrures to a "culture clash" between the acquired and acquiring company. However, we find this is commonly an over reduction of the complexities of people integration. While culture matters, we find that most companies have subcultures among acquired organizations than continue without destroying the overall deal value.

So if it's not culture - what about the People integration strategy degrades deal value?

People integration fails in part because organizations don't link the people integratation strategy to the original deal thesis.

The handoff from the strategy team to the deal team to the dilligence team to the integration team is surrounded by risks and challenges that degrade focus on the value story. In many organizations, integration planning within HR is conducted by HR leaders with little or not involvement in the strategic stages of the deal process. As they engage in dilligence and integration planning, they are often doing so absent an underlying grasp of the deal rationale.

In this article, we suggest a process and some langhuage through which the HR M&A team can gather the insights needed to be more effective at People integration planning. We break this down into a five step process:

- Understand the deal thesis

- Link the key people integration needs to the deal thesis

- Apply desired integration outcomes to organizational segments

- Determine people integration pace to protect deal value

1. Understanding The Deal Thesis

Every deal is different, but many have characteristics in common. Across the acquisitions that we've personally supported, we've found five common archetypes that summarize the value thesis of the deal. It's worth noting that deals can have characteristics of more than one of these types.

Go-to-Market Leverage: Utilize existing channels to drive further volume of acquired product/service

This type of deal involved buying a product/service that is different from your existing offering but is utilized by your current customers. You have the relationships and market presence, and this new offering can fit into that existing go-to-market model. The acquired organization is magnified through the leverage that the acquiring organization provides it.

An example of this deal type might be Disney's acquisitions of various content studios and catalogues. Disney has tremendous existing relationships and assets through which those content offerings can reach incremental audiences. The Star Wars franchise likely wasn't growing materially prior to Disney's acquisition, but post-acquisition Star Wars content is reaching new audiences in new ways and generating incremental value.

Go-to-Market Expansion: Utilize acquired go-to-market model to enter a new channel/segment

This is almost the reverse of the prior type. In this circumstance, you are acquiring a company that has a different go-to-market model or customer segment than you, with the intention of using that go-to-market motion to sell more of what you already sell.

For this archetype, we often think about the set of acquisitions that Allstate has done to diversify it's insurance model, increase assets, and leverage its core risk management capabilities. It purchased Esurance to enter into online distribution rather than an agency-based model. It acquired Square Trade to get into embedded insurance (warranty attached to products you buy in-store). These deals brought new distribution channels and approaches to expand Allstate's customer touchpoints.

Capability Enhancement: Utilize acquired talent/team/tech to fill out key product capabilities

Thinking beyond the go-to-market forms of M&A, this is likely the most common strategic deal rationale. This is when a company spots an opportunity to buy something that makes it a better competitor, with the acquisition being less expensive and/or risky than trying to build that capability itself.

A good exmaple of this archetype might be Google acquiring Android. Android gave Google an important starting point in the mobile market to take on Apple and Microsoft. Similarly, Dell's purchase of EMC could fit this archetype, as it gave the combined Dell EMC a combined offering of devices/serves/storage to better compete on enterprise technology spend.

Many of the "acqui-hire" transactions we see in the software industry fall into this archetype. The acquired product/service may not necessarily be a key new capability, but the skills of the acquired team are expected to generate value by transforming or enhancing existing product/services.

Vertical Consolidation: Increase operating efficiency by owning more of the value chain

In some industries, reliance on a separate supplier or distribution channel degrades value by decreasing customer intimacy, sacrificing margin, or creating uncontrolled risks. By gobbling up those adjacent businesses, the acquiring company creates a more complete business with end-to-end visibility and control of margin.

Examples of deals like this are common in the manufacturing sector, where OEMs acquire component or raw material suppliers. IKEA purchased forests in the Baltic States and in Romania to preserve access and reduce the cost of wood (I wonder if they erver thought of buying a hex wrench maker). AT&T's mega merger with Time Warner is also an exmaple of this type, since AT&T was already distributing Time Warner content and content/service bundles were seen as attractive by consumers.

Scale EBITDA: Realize incremental revenue and cost synergy

This is true for most deals - I've never seen an acquisition announcement or internal plan that doesn't assume some degree of synergy. But it's important to be clear if this is the primary or secondary objective. While the above four archetypes are more transformative, cost syndergy is often a secondary focus. In other transactions, notably among horizontal acquisitions and roll-ups, cost synergy and modest cross-selling are typically the primary rationale.

Airline mergers are examples of this archetype. The entire premise of the merger is to eliminate redundancies and achieve modest incremental revenue through enhanced route networks.

2. People Integration Strategies Linked to Deal Thesis

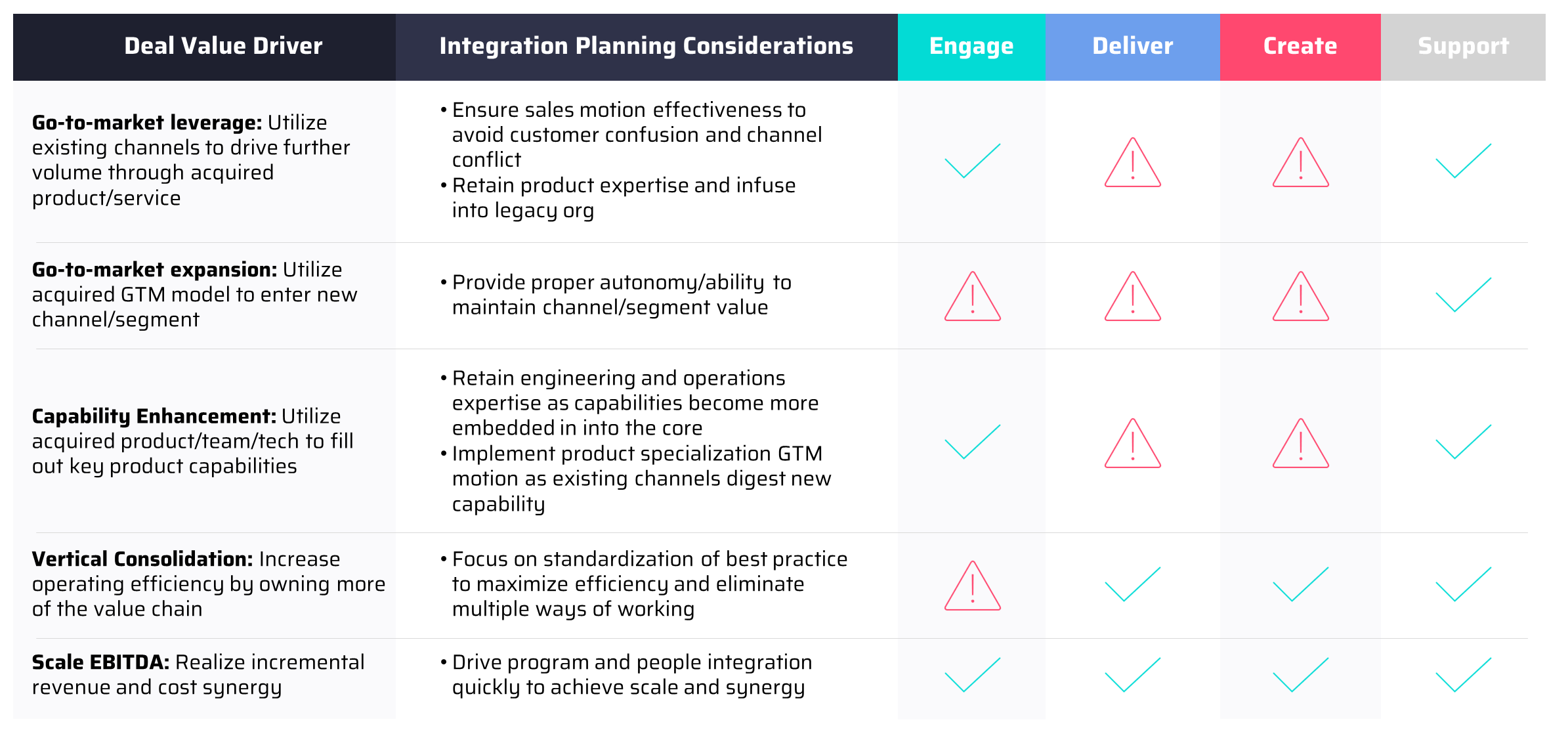

Each of these archetypes - and other flavors of acquisitions - have specific implications for how the combined human capital of the new organization will drive deal value. The deal thesis drives the degree of people integration desirable, the pace of integration, and/or new mechanisms needed to create the right collaboration in the new combined world.

While not exhaustive, the table below illustrate some of the critical people integration planning considerations we've seen in our work with acquisitions of each identified type.

| Deal Value Driver | Integration Planning Considerations |

|

Go-to-Market Leverage Utilize existing channels to drive further volume of acquired product/service |

Ensure sales motion effectiveness to avoid customer confusion and channel conflict Retain product expertise and infuse into legacy org |

|

Go-to-Market Expansion Utilize acquired go-to-market model to enter a new channel/segment |

Provide proper autonomy/ability to maintain channel/segment value |

|

Capability Enhancement Utilize acquired talent/team/tech to fill out key product capabilities |

Retain engineering and operations expertise as capabilities become more embedded into the core Implement product specialization go-to-market motion as existing channels digest new capabilities |

|

Vertical Consolidation Increase operating efficiency by owning more of the value chain |

Focus on standardization of best practice to maximize efficieny and eliminate multiple ways of working |

|

Scale EBITDA Realize incremental revenue and cost synergy |

Drive program and people integration quickly to achieve scale and synergy |

In the table above, note that the planning considerations are quite limited. We are not trying to solve for all functions and all needs, but rather are focused on what drives deal value only. Forcing that level of simplicity clarifies focus and creates a more targeted People integration strategy. The integration plan needs to be segmented based on how value is created for the existing and acquired businesses, but most importantly based on how incremental value will be created via the combined entity.

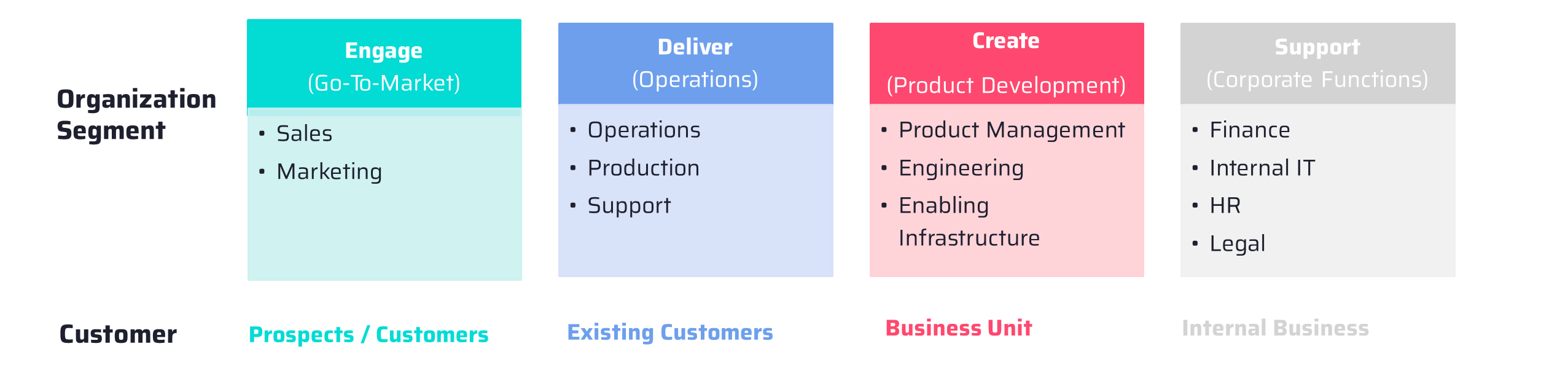

3. Apply Integration Outcomes to Organization Segments

Ultimately, an integration plan will need to be created for the entire organization, not just the key fucntional areas critical to deal value. Having identified how human capital will create value through the deal transition, we find it helpful to segment the rest of the organization into the following four functional clusters, which share a customer and play a similar role in the organization value chain. These segments often tend to function similarly in the deal thesis, creating a simpler but cohesive way to talk about integration strategy.

Organzation Segments

Engage

The functions that touch your end customer directly in the revenue generation process. In B2C organizations, this is relatively small. The customer of this segmemnt are your end customers, both current customers and prospects.

Deliver

The functions that touch your customer directly in the fulfillment process. In many organizations, this is the largest segment. The customer of his segment are your existing, current customers.

Create

The functions that design, develop, and launch the product/service offerings utilized by your Engage and Deliver segments. These teams are the intellectual property and innovation powerhouse of the organization. The customer for their work is the internal business - the Engage abnd Delivery organizations. While of course this team needs to focus on the end customer, we make the case and assume that their work ultimately is "filtered" by the Engage and Deliver teams before making an impact on the end customer.

Support

The functions that provide the underlying programs, infrastructure, and services foe the employees of the organization. These teams exist to remove friction and enable productivity for the internal organization.

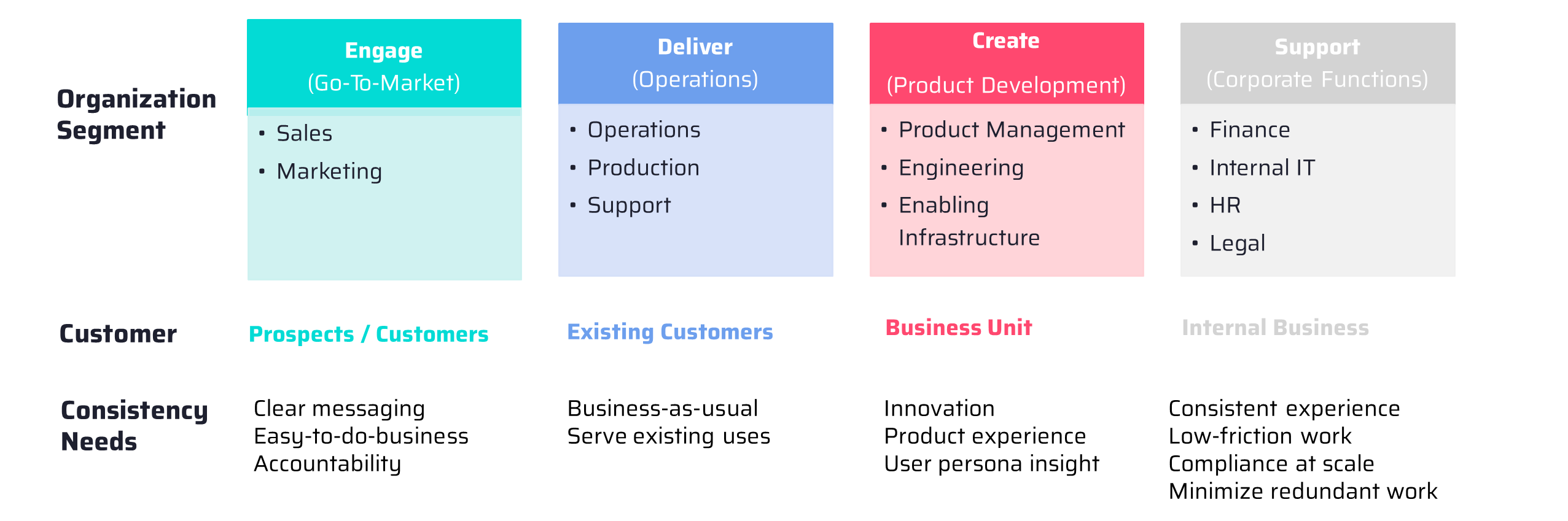

M&A integration strategies need to balance the segment customer's desire for consistency with the organization's desire to drive incremental value.

As such, we should identify the common consistency desires of each customer, by organization functional segment. Understanding why customers desire consistency does not require that no change occur. However, the integration plan needs to respect the desire for consistency as value-creating change is implemented.

Identifying Customer's Consistency Desires

Prospects / Customers

Existing customers of both businesses share one important characteristic: they want the products and services they purchase to work as they expect them to. They didn't ask you to do an acquisition, nor did they ask the acquired firm to be acquired. Above all else, they want their business to see zero disruption. This includes both the product/service experience and the "back office" experience.

In addition, prospects and customers want clarity around how this deal can benefit them. They want a clear story about how innovation or value might increase. This can't come at the expense of existing use cases.

Business Unit

The product/service roadmap can't be disrupted. The business needs to see ongoing innovation, and the quality of innovation should only improve with the combined resources and insights of the new entity. The day-to-day product experience should remain as stable as possible, despite any efforts to create integration between acquired products.

Internal Business

Employees expect a frictionless experience, and don't want to feel disrupted in their employment and work. Employees value having consistent access to the tools they need, and if anything expect greater scale to benefit their employment experience.

4. Integration Speed: "Go" or "Slow"

With a clearer view of the deal thesis, the organization's segments, and what the customers of those segments expect, you can now craft amn integration plan and timeline to generate the expected value while respecting the consistency needs of the organization. While ultimately we assume that the entire organization will "integrate" the below graphic ilustrates how a different pace might be sensible by organization segment.

For example, if the deal is intended to produce go-to-market leverage, pulling the acquired organization's product through your existing channels, it's important to quicky integrate the Engage segments while taking a more measured approach to affecting operations. In contrast, if the deal thesis centers more on cost synergy, a more aggressive pace is sensible across all organization segments.

When and How to Start

Integration strategy should start during due dilligence, as the degree of integration and the timelione for change can often be key drivers of the deal structure and epxected value. Engaging on integration planning early in the deal cycle also improves understanding of the deal context for the integration team, so that integration plans can align appropriately.