Ask ten Talent Acquisition leaders how they measure the recruitment cycle length, and you just might get twelve answers. While many might even use the same words, like Time to Fill, it is often true that the underlying calculation is different across two organizations. This can lead to inaccurate benchmark comparisons, and even worse can result in expensive misinterpretation for business planning.

In this article, we decompose the talent acquisition cycle into various time measurements, each of which can add insight to your recruitment and business planning efforts.

Why This Is Worth Measuring

There is a tremendous business cost to operating with vacant positions: lost direct productivity, added costs to cover, and the drain on other workers who attempt to cover responsibilities while short staffed. As such, leaders often exert pressure on the Talent Acquisition team to fill jobs faster. An aggregate view of the time it takes to fill a role is helpful - but incomplete. Decomposing the length of the cycle can provide insight into improvement opportunities.

The recruitment period, however, is not necessarily the only measurement within the cycle worth understanding. Financial planning teams also need to have a firm grasp on typical position vacancy, which is not the same as the length of the recruitment cycle. As such, a discrete measurement for understanding this critical financial assumption can improve headcount cost planning.

Defining Measurement Time Periods

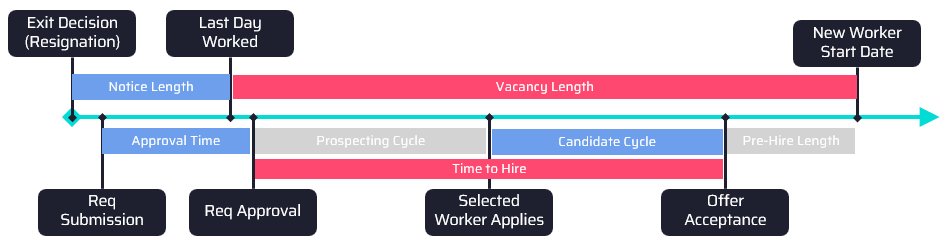

The image below illustrates the seven key dates in the exit-to-fill cycle and the seven measurements that comprise a holistic view of the cycle.

It's important to note that the Requisition Submission and Approval dates can occur in different sequences relative to the Exit Decision and Last Day Worked. In fact, it's quite common that a backfill requisition isn't started until after the prior worker exits, and as a result the "Approval Time" window overlaps with the Vacancy Length rather than the Notice Length.

Primary Measures

In part because the timing of the backfill decision is not fixed relative to when the position vacates, we strongly recommend tracking the following primary metrics separately, ensuring clarity in their definition and usage.

- Vacancy Length: This represents how long the role is unfilled, generating savings by not paying the worker and creating costs via the impact of vacancy. The vacancy length is a business and financial planning metric, not a TA functional performance indicator, since it measures the entire period that the position is not filled by a paid worker.

- Time to Hire: This represents the work of the TA team, measuring the length of time from the order to hire (requisition) through filling that order (offer acceptance). Investments and changes to the TA operating model should drive this metric

Secondary Metrics

In addition to the key measures above, there is added value by understanding the length of the other components of the cycle.

- Notice Length: This is often driven by local contract (outside the U.S.), but is really just driven by custom within the U.S.. "Two weeks notice" is most common but not always true, and understanding how actual notice periods vary can be helpful for understanding how to plan vacancy coverage strategies.

- Pre-Hire Length: Tightly correlated but not identical to the notice length, pre-hire length tends to be slightly longer as many candidates accept an offer but don't give immediate notice to their current employer. Seeing trends in pre-hire length can help shape hiring manager expectations and inform a quality onboarding process.

- Approval Time: Nobody loves to see delays in acquiring great talent due to a slow approval cycle. While there needs to be space for appropriate business to determine if a requisition is approved, this tends to be a friction-filled process in most companies.

- Prospecting Cycle: Represents time spent in recruitment that is prior to the filling candidate applying. In theory this can be zero, if the selected candidate enters the recruitment process on day one.

- Candidate Cycle: Represents the selection timeline for the chosen candidate, from application (or other first-touch indicator) to offer acceptance. The length of the candidate cycle is also a key driver of the candidate experience. Decreasing this window requires efficiency in candidate scheduling, interview management, offer approval cycles, and offer closure.

Plan for Variation

For each of these measurements, we recommend that your strategy for calculating/evaluating anticipate comparing results by certain business dimensions. As notice periods vary substantially by geography, it is critical to be able to segment by country or region. We also find that Candidate Cycle length tends to vary notably by job level and even job function, so preparing to analyze variations by these dimensions can be instructive.

Cautionary Tale

The principal challenge with measuring time to fill and its related components is that it can put too much emphasis on hiring speed, which can degrade hiring quality. What gets measured gets managed... so placing too much emphasis on time to fill can accidently lower the talent bar. Time to fill should be paired with a measure of quality, and tempered by strong governance over candidate selection.